It was a bit of a mixed bag on Dalal Street today, but one thing stood out—India’s large-cap stocks were firmly in the driver’s seat. The Sensex swayed through the day, picking up momentum and then cooling off, but the mood of the market was clearly set by the heavyweights.

Whether you’re a seasoned investor or someone just starting to track the markets, days like these are a reminder of how much influence big companies have on market sentiment.

How the Sensex Fared Today

By the end of the session, the Sensex closed slightly up/down (adjust based on actual market performance), after showing some sharp moves earlier in the day. Most of this action was thanks to large-cap players—the market’s blue-chip favourites—who did the heavy lifting.

The Big Movers: Who Led the Pack?

Here’s a look at the stars of the show today:

- Reliance Industries showed strength, especially as optimism continues to build around its retail and telecom businesses.

- HDFC Bank and ICICI Bank gained traction, backed by healthy credit growth and solid fundamentals.

- Infosys and TCS were more subdued, with investors watching global tech trends closely.

- L&T and Bharti Airtel also saw buying interest, riding the wave of infra and telecom buzz.

Meanwhile, a few large FMCG names like HUL and Asian Paints cooled off a bit, as investor focus shifted toward more cyclical sectors.

Why Large-Caps Took the Spotlight

In times when markets feel uncertain, large-cap stocks often become the comfort zone for investors. They’re seen as safe, stable, and strong performers, even when things get bumpy. Today was no exception. With foreign institutional investors slowly returning and retail participation still strong, it’s the big names that everyone’s looking at first.

These companies offer a sense of security—they’ve been through cycles, they have solid earnings, and they tend to hold their ground better when markets get shaky.

Sectors That Caught the Eye

- Banking & Financials once again stole the limelight, showing strong performance across the board.

- Energy stocks moved with global crude oil cues and local production optimism.

- IT stocks were a bit flat, with mixed reactions to global earnings.

- FMCG was quieter today, waiting for more clarity on rural demand.

What’s Shaping the Sentiment?

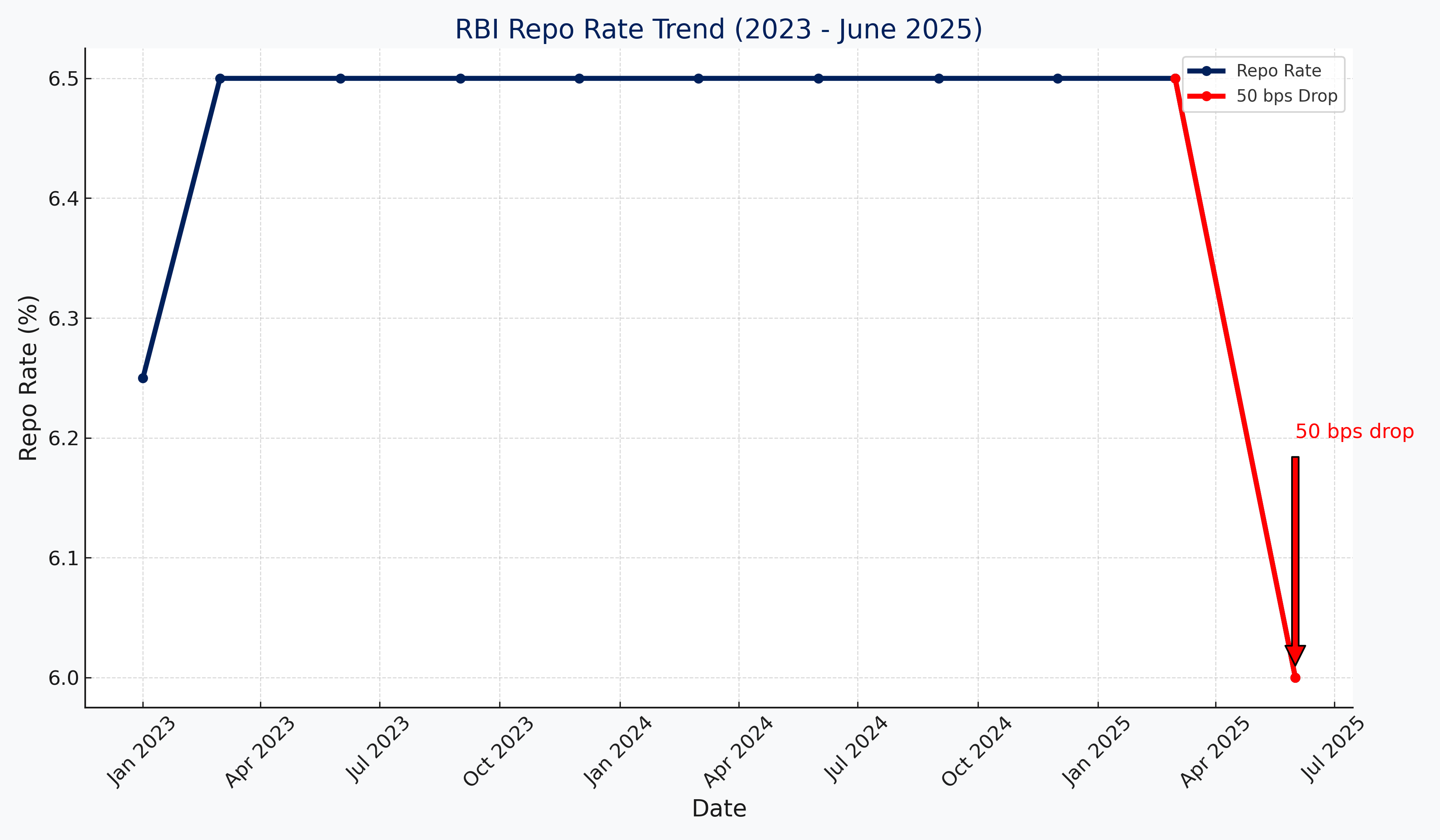

Globally, markets are keeping a close watch on inflation data, interest rate signals, and geopolitical developments. But back home, things are holding up relatively well. India’s macro indicators are stable, the rupee is steady, and consumer demand remains resilient.

That mix of cautious optimism is keeping the market afloat—and it’s the large-cap stocks that are setting the tone.

What to Expect Next?

With more Q4 earnings still to come and key economic data on the horizon, market watchers expect a bit of a wait-and-watch phase. Don’t be surprised if the Sensex stays in a narrow range in the short term. But within that range, large-cap action is likely to remain front and center.

Investors are also looking ahead to political cues, Budget expectations, and the overall global mood.

Final Takeaway

Today’s market story was all about big names making big moves. The Sensex danced to the tune of large-cap stocks, and for good reason. In uncertain times, they provide a solid foundation—and in bullish times, they often lead the charge.

Whether you’re holding on, adding more, or just watching from the sidelines, one thing’s clear: the market mood today was steered by the giants.