Big News for Borrowers Across India

In a move that could bring real relief to your wallet, the Reserve Bank of India (RBI) has cut the repo rate by a full 50 basis points (bps) — bringing it down to 5.75% in June 2025.

Yes, you read that right. A half-percent drop in the key lending rate — and it could directly affect your EMIs, loan interest, and even investments.

What Is the Repo Rate?

Let’s simplify it:

The repo rate is the interest rate at which RBI lends money to banks. When RBI lowers this rate, banks can borrow more cheaply — and ideally, they pass on that benefit to you by lowering interest on loans and EMIs.

So, if you’re paying off a:

- Home loan

- Car loan

- Personal loan

…this repo rate cut could be great news for your monthly payments.

Why Did RBI Do This?

The Indian economy has been under pressure:

- GDP growth slowed to 5.8% in Q4 FY25

- Private consumption has weakened

- Global economic uncertainty is rising

- But — inflation is stable at around 4.2%

With inflation under control, the RBI saw an opportunity to stimulate growth without risking rising prices.

Experts React: “Aggressive, But Necessary”

Here’s what financial experts are saying:

Dr. Raghav Joshi, Financial Analyst

“A 50 bps cut is bold. RBI is clearly prioritizing growth. If banks transmit this rate, we’ll see real benefits at the consumer level.”

Neha Sharma, Economist, Axis Capital

“This cut opens the door to cheaper credit. But the real impact depends on how quickly banks reduce their loan rates.”

Raj Malhotra, Market Strategist

“Equity markets will likely respond positively. Debt investors, though, may see reduced returns.”

What This Means for You

| Financial Area | Expected Impact |

|---|---|

| Home Loans | Lower EMIs possible in 1–2 months |

| Car/Personal Loans | Likely drop in interest rates |

| New Borrowers | Better loan deals ahead |

| FD Interest Rates | May go down |

| Mutual Funds (Debt) | Could underperform slightly |

| Equity Market | May get a temporary boost |

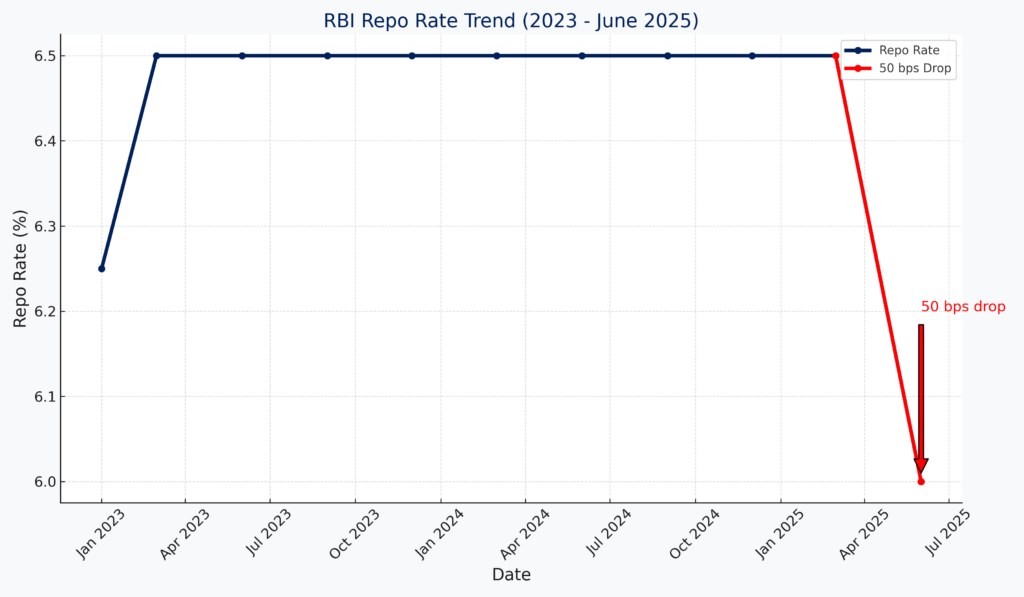

RBI Repo Rate Trend – A Quick Look

From 6.5% in early 2023 to 5.75% in June 2025 — India’s interest rate trajectory shows a clear downward trend to support economic activity.

Featured Image Suggestion:

A clean line graph (1200px wide) showing RBI repo rate from Jan 2023 to June 2025, with the latest 50 bps drop highlighted in red.

What to Watch Now

- Will banks pass on the cut quickly?

- Will there be more repo rate cuts this year?

- How will this impact real estate demand and auto sales?

Final Thoughts: Time to Rethink Your Finances?

This isn’t just a policy update. It’s a real-world moment of opportunity. If you’ve been delaying a home loan, personal loan, or even a refinancing decision — this could be your chance to lock in lower interest rates.

At a time when every rupee matters, this repo rate cut is more than just a number — it’s a step towards affordability and growth.