In a rare turnabout in the bullion market, prices of gold have slipped by ₹6,700 per 10 grams from the recent high point, providing a short-term relief to investors and buyers who were struggling with historic highs. Meanwhile, silver makes further gains, drawing close to the ₹96,000 per kilogram price point, underlining contrasting patterns in the precious metals sector.

Current Market Snapshot

As of the day, gold trades at a little over ₹71,000 for every 10 grams across major metropolitan areas from its current peak of almost ₹77,700. The correction follows an emphatic run sparked by world economic instability, fear of inflation, and diplomatic tension in the recent past. Meanwhile, silver reached ₹95,168 for each kilogram and remains solidly bullish led by strong industry demand and investors’ appetite.

Reasons for the Gold Price Decline

1. Global Indications

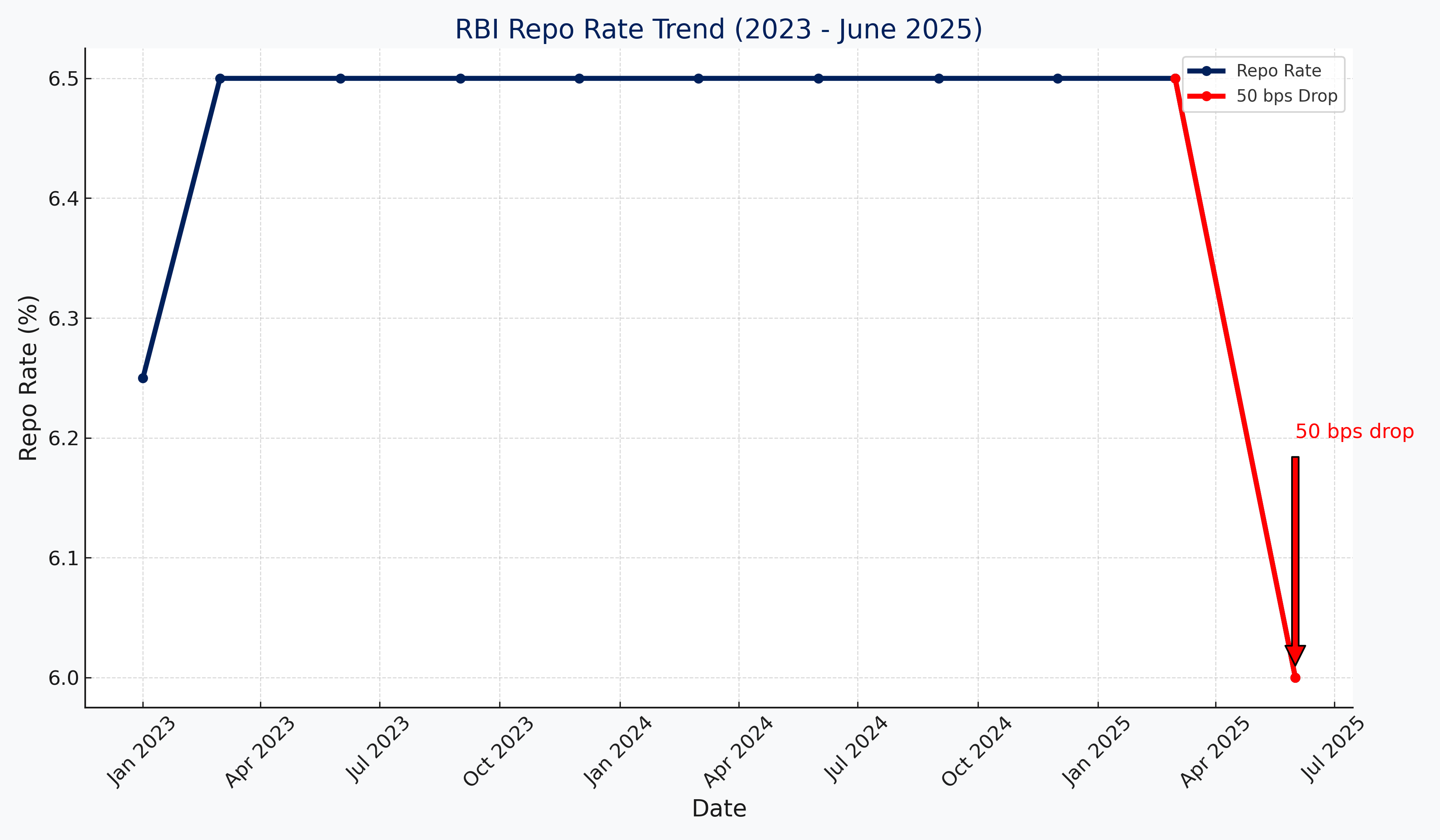

Internationally, gold prices have witnessed a cooling trend as concerns about inflation have eased and the U.S. dollar has remained relatively stable. As recent figures from the U.S. Federal Reserve have shown no imminent rate cuts and indications of economic strength, investors are turning towards riskier assets, draining money from safe havens such as gold.

2. Profit Booking

Following historic highs, most investors decided to take profits, and this led to a corrective phase in local and international markets. The rally that had propelled gold into record levels was always bound to experience some resistance, particularly as physical demand slowed at such high levels.

3. Stronger Rupee

The rupee has strengthened marginally against the dollar in the last few weeks, making the import of gold relatively inexpensive and affecting domestic pricing. India is a top consumer of gold, and currency movements are pivotal in influencing prices at home.

Why Is Silver Still Rising?

Whereas gold has experienced a price correction, silver has kept on rising, helped by robust industrial demand, particularly from industries like solar energy, electronics, and electric vehicles. Experts feel that the dual nature of silver as both a precious and industrial metal makes it more robust during economic transition periods.

Also, speculative purchases and higher futures market participation have added fuel to the fire. As global green energy projects gain momentum, silver should continue on its bullish path for the foreseeable future.

What Does This Mean for Buyers and Investors?

For those waiting on the sidelines, the correction in gold provides a potential entry point for long-term investment. Although the price remains considerably higher than pre-2020 levels, any sudden drop in gold is usually viewed as an opportunity by experienced investors who view it as a hedge against inflation and economic uncertainty.

Conversely, increasing price of silver can invite restraint among buyers, particularly in the industrial and jewelry segments. Yet, owing to its high utility and comparatively lower price relative to gold, silver remains popular.

Outlook Ahead

Market analysts opine that gold will get good support near the ₹70,000 level, and any further downfall would be contained unless there is a drastic change in global monetary policy or geopolitical peace. Silver, on the other hand, could test ₹96,500 or even ₹97,000 in the short run if current momentum persists.

Investors should be mindful of future U.S. economic data, central bank policy choices, and the health of global equity markets in order to better gauge the next precious metals move.

Final Thoughts

The movement of silver and gold in opposite directions highlights the intricate nature of the international precious metals market. While gold is cooling down after a record high, silver is getting brighter by the day. For investors, the next few weeks will be decisive in establishing whether this is a short-term phenomenon or the start of a new bullion trend.